|

The following article was originally published in August 2001. Some minor

edits have been incorporated for readability, but all information is still

current as of that time.

In a world in which account size and margin are irrelevant and counter-seasonality

does not exist, trading a seasonal methodology is a no-brainer. You simply enter

and exit seasonal strategies on the appropriate days for each trade. In other

words, your account is large enough to take every strategy without worrying

about whether you have enough margin or whether this will be the year in which a

particular strategy decides to head south. Unfortunately, few people have both

the resources and the desire to take every single seasonal strategy and also to

sit through any and all drawdowns.

Moore Research Center, Inc. (MRCI) has found that our own previously

published seasonal strategies would have generated optimal results by trading

each and every strategy and without using stops. In real time, however, traders

must be practical, for most have limited or, at least, finite resources and do

not inhabit the hypothetical world of unlimited funds. Thus, drawdowns and

allocation of resources are vitally important components of trading. We intend

to introduce several ways to evaluate seasonal strategies to optimize selections

before even considering technical or fundamental analysis, instead addressing

margin, historical return, consistency, and volatility.

Performance Bond (Margin)

No analysis of return would be complete without discussing margin (performance

bond) and its restrictions on diversifying a portfolio. An example of where

this could be extremely important would be in trading S&P 500 futures. The

current exchange minimum margin(on June 11, 2001) for the full-sized S&P 500 was

$21,563 initial/ $17,250 maintenance. However, the initial margin for the E-mini

was only $4,313, while maintenance is $3,450. Many traders would better utilize

their funds by trading E-mini contracts instead of the full-sized version,

saving funds to diversify into other markets with other strategies.

Historical Return

The basis for our analysis of historical return is a December British Pound

seasonal strategy:

Pos |

Market |

Mth |

Entry |

Exit |

Win

Pct |

Win |

Lose |

Total |

Avg

Profit |

Avg/

Day |

| Buy |

British Pound(IMM) |

Dec |

8/17 |

10/14 |

80 |

12 |

3 |

15 |

1471 |

25.37 |

Incorporating margin into a basic analysis of rate-of-return results in the

following formula for the above British Pound strategy:

Historical Average Profit

Initial Margin |

times |

Days In Year

Days In Trade |

times 100% equals |

Return on

Investment |

This computation takes into account the relationship between the strategy's

historical profit, current margin, and length of exposure. To illustrate the

point, if we compare an S&P 500 strategy with the same historical average profit

but with an initial margin of $21,563, the value would be approximately 41%.

Stated another way, historical average profits of $22,331 would be required to

get the same rate of return on margin required. Thus, the former appears to

be a much more palatable, realistic, and profitable strategy.

| British Pound = |

1471

1418 |

x |

365

60 |

x 100 = 631% |

| S&P 500 = |

1471

22563 |

x |

365

60 |

x 100 = 41% |

Consistency

To evaluate consistency, let's examine the December British Pound strategy

detail.

| British Pound(IMM)-December |

| Buy on approximately 08/17 - Exit on approximately 10/14 |

Contract Size: 62,500 British Pounds |

Cont

Year |

Buy

Date |

Buy

Price |

Exit

Date |

Exit

Price |

Profit |

Profit

Amount |

Best

Equity

Date |

Best

Equity

Amount |

Worst

Equity

Date |

Worst

Equity

Amount |

| 2000 |

08/17/00 |

150.26 |

10/13/00 |

145.36 |

-4.90 |

-3062.50 |

|

|

09/15/00 |

-6337.50 |

| 1999 |

08/17/99 |

160.58 |

10/14/99 |

166.46 |

5.88 |

3675.00 |

10/14/99 |

3675.00 |

08/25/99 |

-1175.00 |

| 1998 |

08/17/98 |

160.56 |

10/14/98 |

169.96 |

9.40 |

5875.00 |

10/08/98 |

6225.00 |

|

|

| 1997 |

08/18/97 |

160.38 |

10/14/97 |

161.68 |

1.30 |

812.50 |

09/25/97 |

1187.50 |

09/04/97 |

-1712.50 |

| 1996 |

08/19/96 |

154.34 |

10/14/96 |

157.98 |

3.64 |

2275.00 |

10/14/96 |

2275.00 |

|

|

| 1995 |

08/17/95 |

154.48 |

10/13/95 |

157.14 |

2.66 |

1662.50 |

09/21/95 |

3112.50 |

08/22/95 |

-950.00 |

| 1994 |

08/17/94 |

153.90 |

10/14/94 |

159.30 |

5.40 |

3375.00 |

10/14/94 |

3375.00 |

08/26/94 |

-650.00 |

| 1993 |

08/17/93 |

147.64 |

10/14/93 |

150.90 |

3.26 |

2037.50 |

09/10/93 |

4112.50 |

08/25/93 |

-375.00 |

| 1992 |

08/17/92 |

188.34 |

10/14/92 |

169.08 |

-19.26 |

-12037.50 |

09/08/92 |

5337.50 |

10/08/92 |

-13775.00 |

| 1991 |

08/19/91 |

159.92 |

10/14/91 |

169.84 |

9.92 |

6200.00 |

10/03/91 |

8475.00 |

|

|

| 1990 |

08/17/90 |

188.36 |

10/12/90 |

194.94 |

6.58 |

4112.50 |

10/11/90 |

4837.50 |

09/21/90 |

-4225.00 |

| 1989 |

08/17/89 |

153.64 |

10/13/89 |

155.14 |

1.50 |

937.50 |

09/26/89 |

4187.50 |

09/05/89 |

-1287.50 |

| 1988 |

08/17/88 |

167.66 |

10/14/88 |

174.84 |

7.18 |

4487.50 |

10/14/88 |

4487.50 |

09/01/88 |

-1687.50 |

| 1987 |

08/17/87 |

157.90 |

10/14/87 |

165.35 |

7.45 |

4656.25 |

10/14/87 |

4656.25 |

|

|

| 1986 |

08/18/86 |

147.20 |

10/14/86 |

142.50 |

-4.70 |

-2937.50 |

08/20/86 |

937.50 |

10/08/86 |

-3843.75 |

| Percentage Correct |

80 |

|

|

|

| Average Profit on Winning Trades |

5.35 |

3342.19 |

|

Winners |

12 |

| Average Loss on Trades |

-9.62 |

-6012.50 |

|

Losers |

3 |

| Average Net Profit Per Trade |

2.35 |

1471.25 |

|

Total trades |

15 |

SEASONAL TENDENCIES ARE A COMPOSITE OF SOME OF THE MORE CONSISTENT COMMODITY FUTURES SEASONALS THAT

HAVE OCCURRED OVER THE PAST 15 YEARS. THERE ARE USUALLY UNDERLYING FUNDAMENTAL CIRCUMSTANCES THAT

OCCUR ANNUALLY THAT TEND TO CAUSE THE FUTURES MARKETS TO REACT IN A SIMILAR DIRECTIONAL MANNER

DURING A CERTAIN CALENDAR PERIOD OF THE YEAR. EVEN IF A SEASONAL TENDENCY OCCURS IN THE FUTURE, IT

MAY NOT RESULT IN A PROFITABLE TRANSACTION AS FEES, AND THE TIMING OF THE ENTRY AND LIQUIDATION MAY

IMPACT ON THE RESULTS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT HAS IN THE PAST OR WILL IN

THE FUTURE ACHIEVE PROFITS UTILIZING THESE STRATEGIES. NO REPRESENTATION IS BEING MADE THAT

PRICE PATTERNS WILL RECUR IN THE FUTURE.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS,

SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE

THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR

TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN

HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY

ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS

OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY

PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL

TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD

CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING.

FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING

PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY

AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE

MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH

CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS

AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. RESULTS NOT ADJUSTED

FOR COMMISSION AND SLIPPAGE.

|

Upon evaluating the Best Equity Amount and Profit Amount columns, we

see that 12 of the 15 years saw an open equity greater than the historical

average profit and 10 of them closed out with equity greater than the average.

This trade has been extremely consistent. This type of consistency would seem

much more reliable than one which saw an open equity greater than the historical

average in, for example, only 7 out of 15 years and which closed greater in only

5.

Interestingly enough, in this example two of the three years, which did not see

at least the historical average, resulted in losing trades. One (2000) never

had a closing profit at all, while the other (1986) peaked three days into the

trade and then failed. Looking at a chart, we see that the market did make one

attempt to rally but failed before selling off dramatically. The third year (1992)

deserves separate mention. This particular year saw significant early open

equity but then lost dramatically. We mention this separately because this was

the result of a one-time governmental intervention which directly devalued the

pound and which could not have been foreseen by historical research. Do your

homework! When you find catastrophic results like this, try to find out what

happened and why and then evaluate the probabilities of something similar

happening again. Attempt to analyze around the results. Do not forget about

them, as they are a potent reminder of how risky trading really is, but attempt

to exclude such extremes when evaluating practical stops.

Interestingly enough, in this example two of the three years, which did not see

at least the historical average, resulted in losing trades. One (2000) never

had a closing profit at all, while the other (1986) peaked three days into the

trade and then failed. Looking at a chart, we see that the market did make one

attempt to rally but failed before selling off dramatically. The third year (1992)

deserves separate mention. This particular year saw significant early open

equity but then lost dramatically. We mention this separately because this was

the result of a one-time governmental intervention which directly devalued the

pound and which could not have been foreseen by historical research. Do your

homework! When you find catastrophic results like this, try to find out what

happened and why and then evaluate the probabilities of something similar

happening again. Attempt to analyze around the results. Do not forget about

them, as they are a potent reminder of how risky trading really is, but attempt

to exclude such extremes when evaluating practical stops.

Volatility

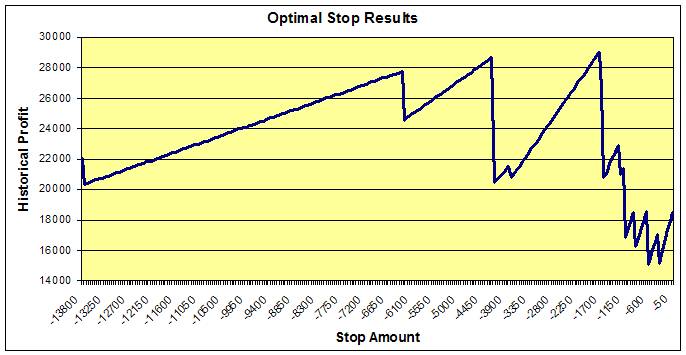

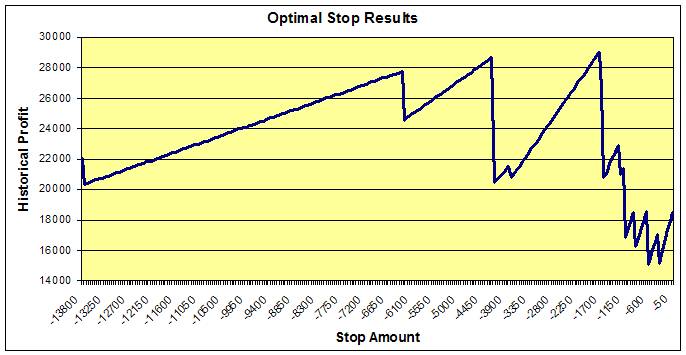

When discussing volatility in this particular instance, we're really talking

about comfort. Is this trade so wildly volatile that enormous drawdowns must be

suffered in the hope of ending with profits? Or can one sleep nights, enduring

an acceptable level of volatility (acceptable being relative for each individual,

of course). In this particular case, we attempted to optimize a protective stop

by evaluating every possible value from of $50 to $13,800 (1992's worst drawdown,

rounded up) in $50 increments. This stop optimization, shown in the

accompanying graph, resulted in an optimal stop of $1,750. (Note the dramatic

saw-tooth transitions as each year's worst drawdown is picked up and historical

profit increases until the next, with the peak amount showing up between the

drawdowns for winning and losing years.) Using $1,750 as a stop, this trade

would have succeeded in 11 of 15 years and raised the average annual return to

$1,933. So, by simply analyzing drawdown, one could have increased the average

annual return by over 30% with a only minor drop in winning trade percentage. In

addition, one could have predetermined his dollar-risk to only 19% more than

the theoretical return.

There are other methodologies for establishing personally acceptable risk. The

primary concept is that it simply needs to be accomplished. One may not always

be able to improve return while reducing risk, but the idea is to sleep better

and play the game longer.

Conclusion

Finally, every seasonal trade is not for every trader. Account size limits

ability to absorb risk as well as to diversify and to maintain multiple

positions. Personal temperament determines one's emotional ability to accept

risk, to weather drawdowns, and to "stay with the program." The amount of time

available to monitor and evaluate markets also drives how selective a trader can

and must be.

The purpose of this discussion has been to help traders with finite resources to

evaluate and better select from among potential seasonal strategies to trade in

real-time without, or at least before, analyzing current technical or

fundamental conditions. Even the best analysts cannot see into the futures and

predict what the market will do. Thus, taking the time well in advance to

objectively evaluate the relative merits based on current margin requirements,

rate of historical return, consistency of gain, and volatility of a group of

seasonal strategies can make the difference between sleeping well, surviving,

and prospering versus becoming only a spectator.

| *There is a risk of loss in futures trading. |

|

MRCI Online

MRCI Online

Interestingly enough, in this example two of the three years, which did not see

at least the historical average, resulted in losing trades. One (2000) never

had a closing profit at all, while the other (1986) peaked three days into the

trade and then failed. Looking at a chart, we see that the market did make one

attempt to rally but failed before selling off dramatically. The third year (1992)

deserves separate mention. This particular year saw significant early open

equity but then lost dramatically. We mention this separately because this was

the result of a one-time governmental intervention which directly devalued the

pound and which could not have been foreseen by historical research. Do your

homework! When you find catastrophic results like this, try to find out what

happened and why and then evaluate the probabilities of something similar

happening again. Attempt to analyze around the results. Do not forget about

them, as they are a potent reminder of how risky trading really is, but attempt

to exclude such extremes when evaluating practical stops.

Interestingly enough, in this example two of the three years, which did not see

at least the historical average, resulted in losing trades. One (2000) never

had a closing profit at all, while the other (1986) peaked three days into the

trade and then failed. Looking at a chart, we see that the market did make one

attempt to rally but failed before selling off dramatically. The third year (1992)

deserves separate mention. This particular year saw significant early open

equity but then lost dramatically. We mention this separately because this was

the result of a one-time governmental intervention which directly devalued the

pound and which could not have been foreseen by historical research. Do your

homework! When you find catastrophic results like this, try to find out what

happened and why and then evaluate the probabilities of something similar

happening again. Attempt to analyze around the results. Do not forget about

them, as they are a potent reminder of how risky trading really is, but attempt

to exclude such extremes when evaluating practical stops.